On Wednesday, the European Commission initiated an inquiry to determine the potential imposition of punitive tariffs. These tariffs are intended to safeguard European Union manufacturers from the influx of less expensive Chinese EV imports, which are believed to be receiving advantages from government subsidies.

The Commission will conduct an assessment over a period of up to 13 months to decide whether tariffs should be applied, potentially exceeding the standard 10% EU rate for automobiles. This case represents a significant confrontation between the EU and China, marking the most prominent since a European investigation into Chinese solar panels narrowly averted a trade conflict about a decade ago.

Global markets are now flooded with cheaper electric cars. And their price is kept artificially low by huge state subsidies.

Ursula von der Leyen, President of the European Commission

The European Commission is investigating subsidies affecting electric cars, covering both Chinese and non-Chinese brands produced in China like Tesla, Renault, and BMW. This inquiry, unusual in that it’s initiated by the Commission itself rather than a industry complaint, aims to level the playing field.

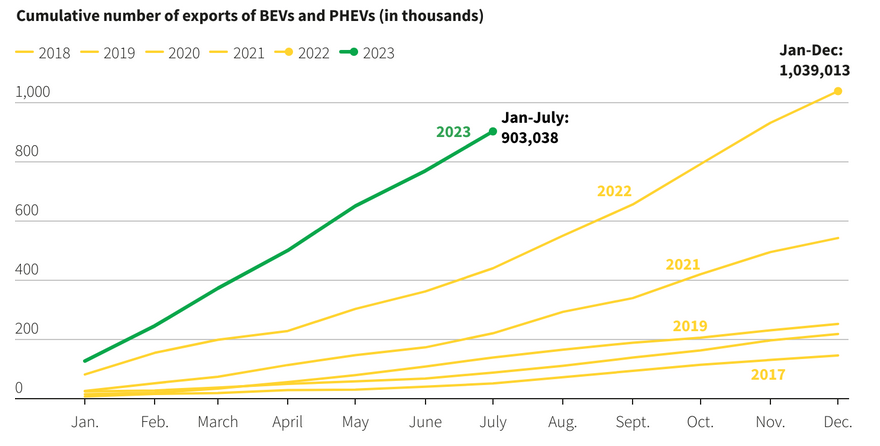

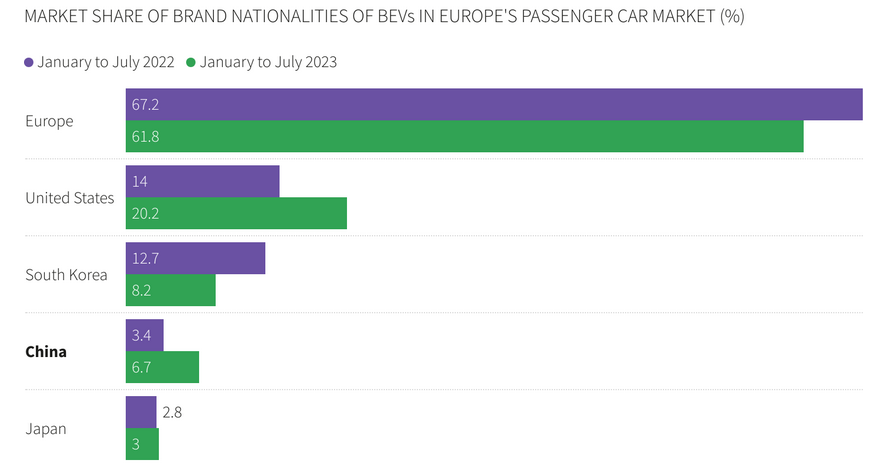

Tensions are rising between the EU and China due in part to China’s closer ties with Moscow following the Ukraine conflict. The EU is seeking to reduce its dependence on China for materials needed for its green transition. Meanwhile, European automakers are striving to compete with China’s lead in affordable electric vehicles. Chinese electric vehicle manufacturers, like BYD, Xpeng, and Nio, are expanding abroad as competition grows at home, with China’s auto exports surging by 31% in August. The European Commission notes that China’s electric vehicle market share in Europe has reached 8% and could rise to 15% by 2025, with Chinese models typically priced 20% lower than EU-made ones, including popular exports like SAIC’s MG and Geely’s Volvo.

Rising Chinese Exports of New Energy Vehicles (NEVs)

Chinese electric vehicle (EV) manufacturers saw their stock prices decline following the EU’s announcement. BYD, initially up by 4.5% before the news, ended the day down by 2.8%, while Nio experienced a 1% drop, and Xpeng fell by 2.5%. European carmakers such as Volkswagen, BMW, Mercedes-Benz, and Stellantis briefly enjoyed slight gains upon hearing the news, although they later retraced much of those gains. For instance, VW was up by 0.2%, and Stellantis was down by 0.2% as of 14:15 GMT.

To counter the influx of more affordable Chinese electric vehicles, some European carmakers like Renault have already announced plans to reduce production costs for their electric models by 40%. Additionally, these companies are grappling with increased competition from U.S. rival Tesla, which has repeatedly lowered its prices this year, albeit at the expense of its profit margins.

Chinese brands are gaining ground in Europe’s BEV market

Chinese state support for electric and hybrid vehicles amounted to $57 billion between 2016 and 2022, according to consulting firm AlixPartners. This substantial backing played a significant role in propelling China to become the world’s largest electric vehicle (EV) producer and surpass Japan as the top auto exporter in the first quarter of this year.

Although China discontinued its generous 11-year subsidy program for EV purchases in 2022, some local authorities have continued to provide assistance, including tax rebates and incentives for attracting investments, as well as subsidies for consumers.

In April, the founder of Nio cautioned Chinese EV manufacturers about potential protectionist measures by foreign governments. He believed that his company and other Chinese peers enjoyed a cost advantage of up to 20% compared to rivals like Tesla, thanks to China’s control over the supply chain and raw materials. According to Kingsmill Bond, a senior principal at the Rocky Mountain Institute’s strategy team, Chinese producers in 2022 benefited from lower EV battery prices, paying $130 per kilowatt hour compared to the global price of $151.

The EU’s investigation encompasses a wide range of potential unfair subsidies, spanning from raw material and battery prices to preferential lending and the provision of inexpensive land.