Apple Pay Later has now been officially rolled out for all eligible residents in the United States. Previously, it was only accessible through an invite-only “early access” phase starting in March.

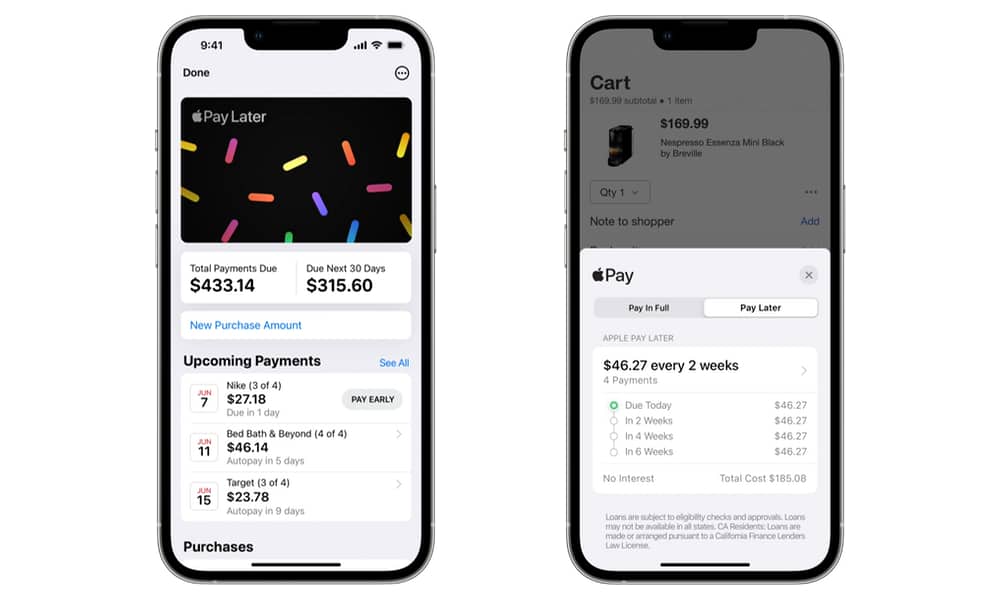

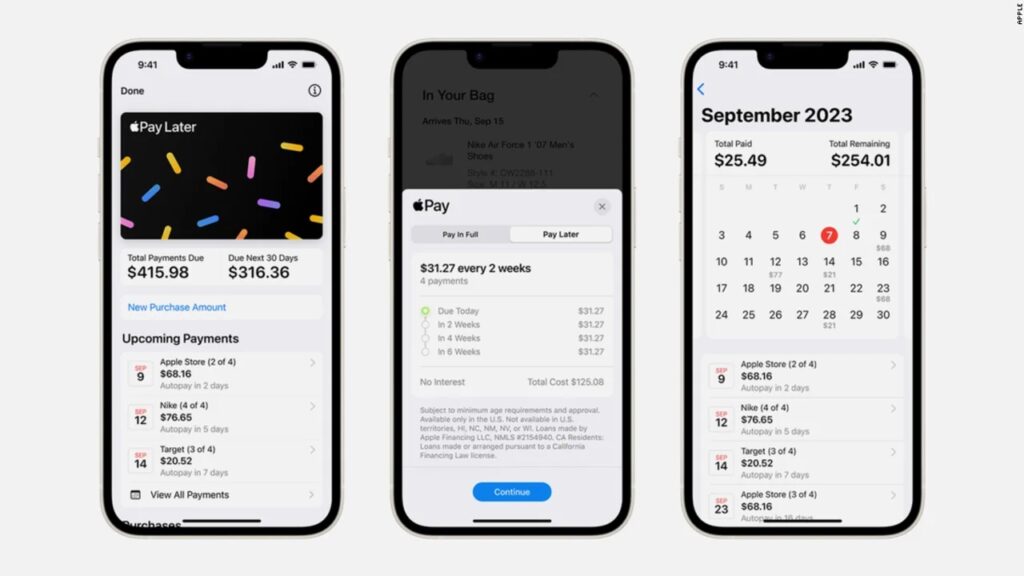

Apple Pay Later, a “buy now, pay later” feature, enables qualifying customers to divide their Apple Pay purchases into four equal payments over a six-week period, without incurring interest or fees. This feature is applicable for eligible purchases ranging from $75 to $1,000, made on an iPhone or iPad, on most websites and apps that support Apple Pay.

During the early access period, the minimum purchase requirement for Apple Pay Later was $50, but Apple has since increased it to $75. Each purchase made with Apple Pay Later constitutes a separate loan application, and these applications do not impact your credit score, according to Apple. This service is available to U.S. residents aged 18 or older, although it is currently not accessible in Hawaii, New Mexico, Wisconsin, and U.S. territories.

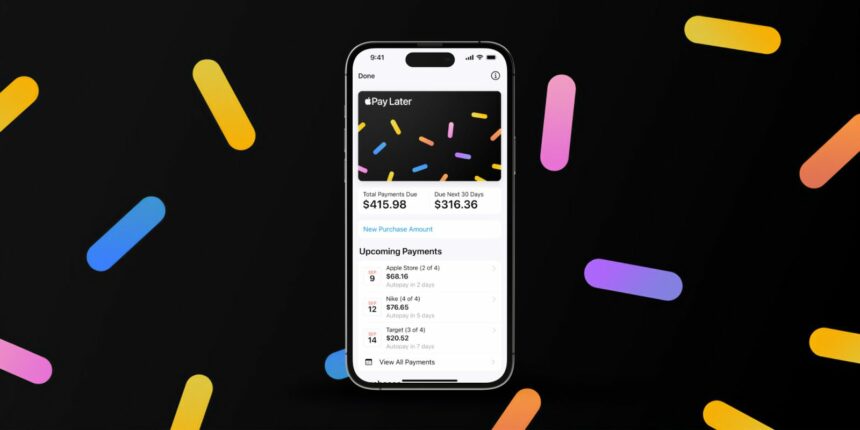

Apple Pay Later is integrated into the Wallet app on the iPhone and can be found in the Settings app under Wallet & Apple Pay on the iPad. Users can manage their loans, view upcoming payments on a calendar, and receive payment reminders via Wallet notifications and email. Users are required to set up a debit card as a method for repaying their loans.