Former cryptocurrency mogul Sam Bankman-Fried has been convicted of fraudulent activities. A New York jury reached this decision on November 2nd, following a trial in which Bankman-Fried defended himself against allegations of criminal mismanagement related to his crypto exchange FTX and trading company Alameda Research.

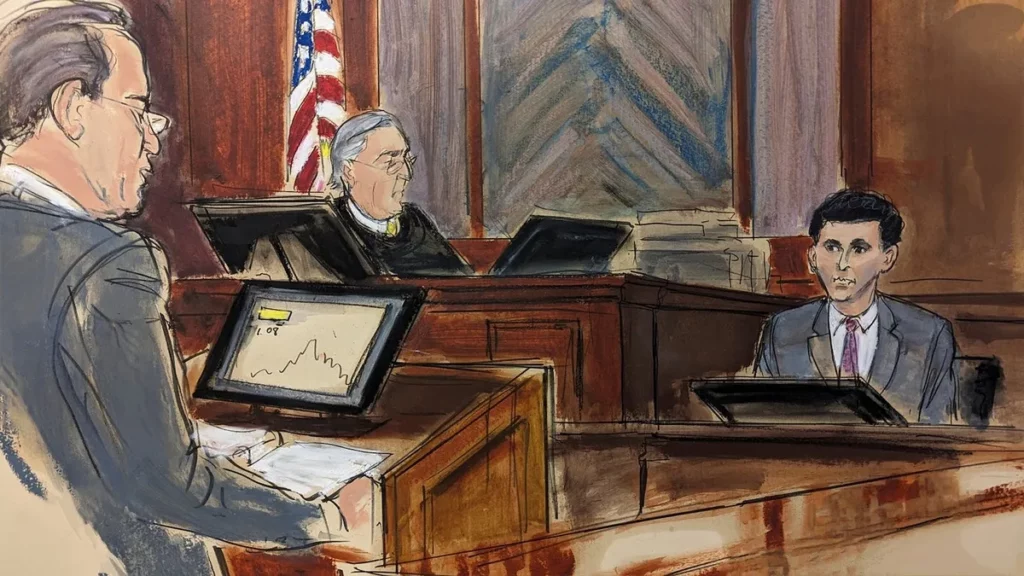

After more than a month in court, the jury deliberated for four and a half hours before finding Bankman-Fried guilty on all seven charges, which included wire fraud, conspiracy to commit wire fraud, and conspiracy to commit money laundering. He is scheduled for sentencing by Judge Lewis Kaplan on March 28th of the next year and could face a lengthy prison term.

Bankman-Fried founded FTX in 2019, and its value skyrocketed during the post-pandemic cryptocurrency boom. However, prosecutors claimed that the operation was fraudulent “from the beginning.” Despite promoting the exchange as safe and secure to investors and the public, Bankman-Fried’s former associates testified that it manipulated data and provided undisclosed privileges to Alameda, including a $65 billion credit line and allowing Alameda’s account balance to dip into negative territory as it improperly borrowed FTX customer funds.

The FTX empire crumbled after a November 2022 Coindesk article revealed the improper mingling of funds, and Binance CEO Changpeng “CZ” Zhao announced his withdrawal from the exchange. Bankman-Fried resigned, and FTX filed for bankruptcy. He subsequently faced civil and criminal charges related to fraud and money laundering.

In the lead-up to his trial, Bankman-Fried had conflicts with prosecutors and the court. Initially placed under house arrest, he was incarcerated in August for violating his bail conditions, which included using a VPN to watch a football game and leaking his ex-girlfriend’s diary entries to The New York Times. His ex-girlfriend, former Alameda Research CEO Caroline Ellison, had pleaded guilty to federal charges and testified against him in the trial.

This case has further damaged the reputation of the crypto industry, given Bankman-Fried’s prominent status as a representative of the sector. Several other major companies in the cryptocurrency space face civil or criminal charges in the US and abroad, and some have experienced abrupt collapses similar to FTX’s. During the trial, Bankman-Fried’s defence argued that he had honestly failed in operating a high-risk business.

He denied direct involvement in overseeing the code updates that allowed Alameda to access FTX funds and claimed he had not participated in trading or questioned employees about the disappearance of billions of dollars. However, his testimony was contradicted by Ellison, his former roommates Adam Yedidia and Gary Wang (the co-founder of FTX), and family friend Nishad Singh, all of whom had worked under Bankman-Fried and later cooperated with prosecutors. Wang, Singh, and Ellison are awaiting sentencing.