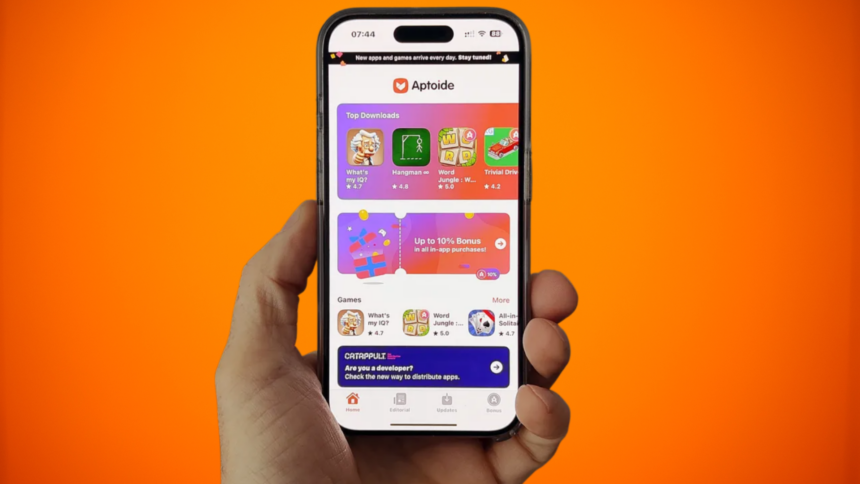

The launch of Aptoide as an alternative iOS app marketplace marks a significant development in the ongoing saga of challenging Apple’s stronghold on app distribution in Europe. Following the Digital Markets Act (DMA) which mandates Apple to support third-party iOS app stores, Aptoide joins a nascent but growing field of competitors. The Portuguese company, known for its prominence as an Android app distributor, is now setting its sights on the iOS ecosystem with a focus exclusively on games.

The current landscape of alternative iOS marketplaces

Since the DMA’s enforcement in March, several third-party iOS app stores have emerged, though none have yet made a substantial impact. Mobivention, the first to launch, targets business users by distributing enterprise apps. AltStore PAL, another early entrant, aimed to leverage an iOS emulator but saw its unique selling point diluted when Apple included similar software in its own store. Setapp Mobile, still in closed beta, offers a subscription-based model for productivity tools.

Each of these marketplaces promised disruption but has faced significant challenges. AltStore PAL, for instance, has struggled with Apple’s notarization process, resulting in a meager offering of just two apps months after its launch. Setapp Mobile has shown more promise, growing from 13 to 37 apps in a few weeks, but it’s still in its early stages.

Aptoide’s unique offering

Aptoide’s new iOS marketplace is distinct in several ways. Available initially as an invite-only beta, it exclusively offers games through a freemium model. This could prove attractive to both developers and users. The marketplace currently hosts eight basic games, with plans to expand significantly as more developers come on board. CEO Paulo Trezentos revealed that 100 developers are interested in joining the platform, with 30 already in the technical integration phase.

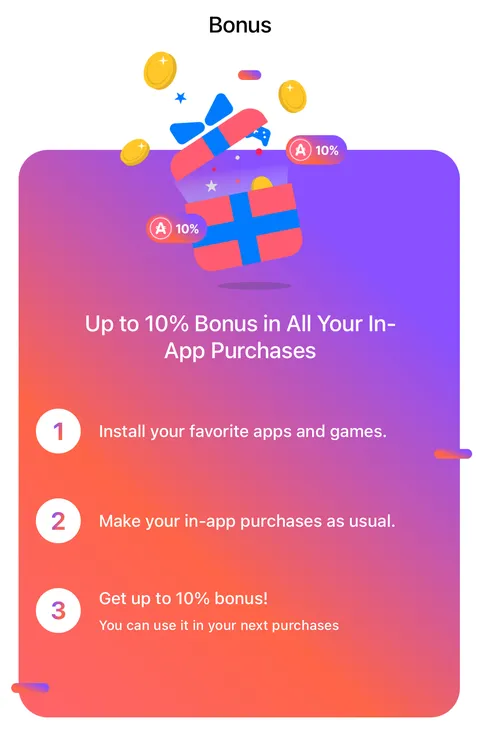

A key differentiator for Aptoide is its reward structure for in-app purchases. Unlike the Apple App Store, Aptoide offers bonuses, effectively providing a 5 to 10 per cent discount for frequent in-app spenders. This could appeal to regular gamers looking for cost savings.

For developers, Aptoide presents a more favourable financial model. It charges a 20 per cent fee for organic in-app purchases and a 10 per cent fee for purchases driven by independent advertising. This is notably lower than Apple’s standard 30 per cent fee. Additionally, Aptoide supports developers financially by offering between $1,000 and $2,000 to those launching games on its platform and covering the Core Technology Fee itself, unlike its competitors who pass this fee to users.

Challenges ahead

Despite these advantages, Aptoide faces significant hurdles. The reliance on in-app purchases may not sit well with tech enthusiasts, the primary audience likely to explore third-party app stores. Furthermore, the quality and exclusivity of the games available will be crucial. If the offerings remain limited to basic games already available on Apple’s platform, it may struggle to justify the effort required to install and use a third-party app store.

Aptoide’s success will depend on its ability to attract high-quality, exclusive games and to convince both developers and users of its value proposition. While the early stages have shown promise, the marketplace has yet to prove it can significantly disrupt Apple’s dominance.

The future of third-party iOS App Stores

The entry of Aptoide into the iOS ecosystem is a notable development in the broader context of digital market regulation and competition. While early alternative app stores have yet to shake Apple’s stronghold, the landscape is still in its infancy. The real test will come as these marketplaces mature and expand their offerings.

As it stands, Aptoide is poised to carve out a niche with its game-focused, freemium model. Its developer-friendly approach and financial incentives could attract a steady stream of quality games, potentially drawing in users seeking variety and value not found in the Apple App Store. However, only time will tell if Aptoide can thrive where others have struggled and bring about the significant disruption many have hoped for.

In this evolving battle for app distribution supremacy, Aptoide represents a promising, if uncertain, new challenger. As third-party app stores continue to develop under the DMA’s regulatory framework, the dynamics of the app marketplace could undergo a significant transformation. For now, Apple retains its dominant position, but the game is far from over.